tax shield formula uk

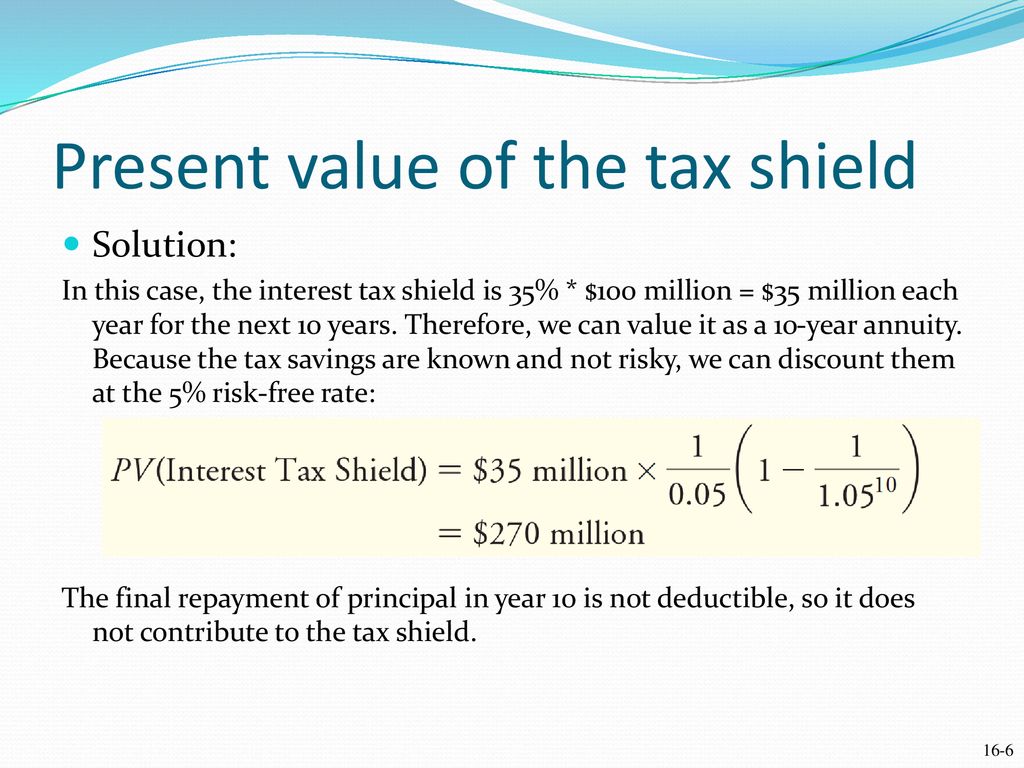

In simple words we can say a tax shield is the PV Present Value of future tax saving attributes to tax deductibility of a particular expense in P and L Account ie profit loss account. Tax and accounts software for accountants tax specialists SMEs and business owners Your Account Your Basket Support.

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Depreciation Tax Shield Formula.

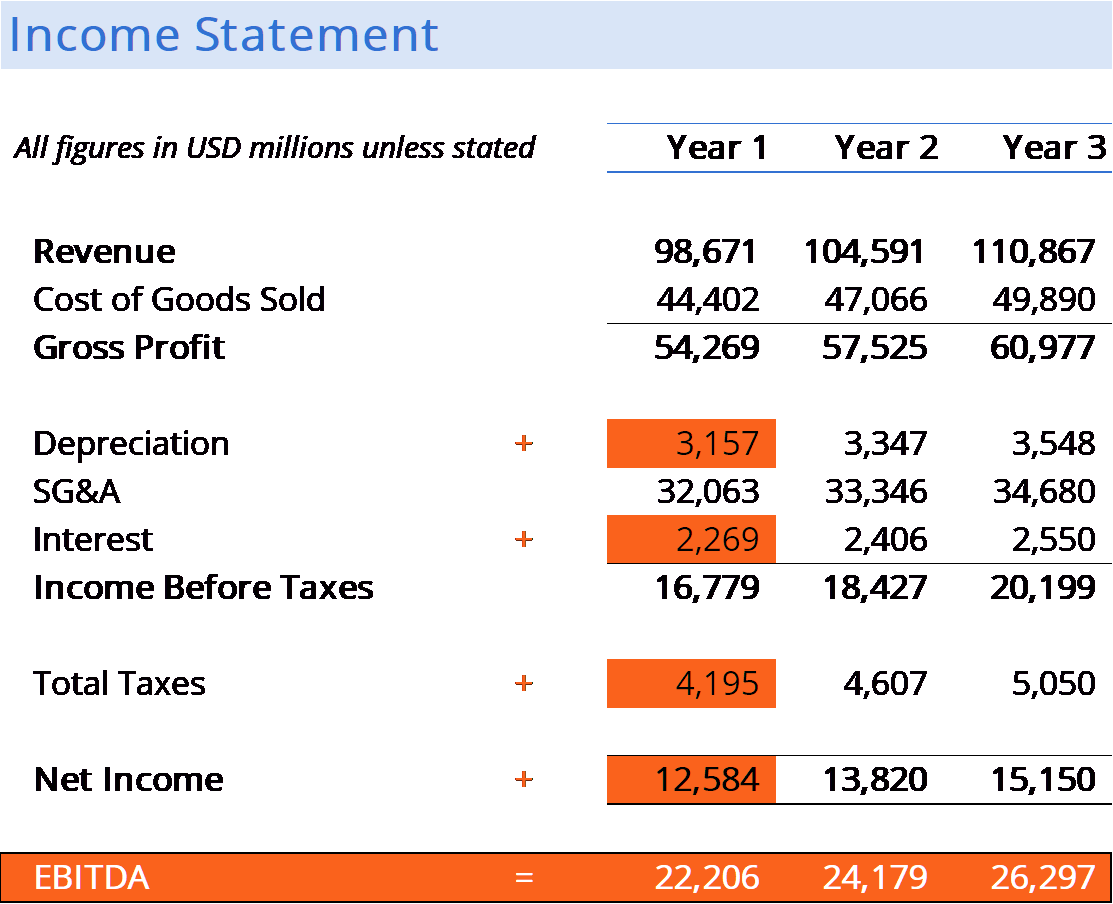

. 44 0870 609 1918 charges may. Depreciation Tax Shield Depreciation Expense Tax Rate If feasible annual depreciation expense can be. Interest Tax Shield Formula Average debt Cost of debt Tax rate.

The effect of a tax shield can be determined using a formula. What is the formula for tax shield. TAX to be Paid over Income Revenues- Operating Expenses-Depreciation-Interest.

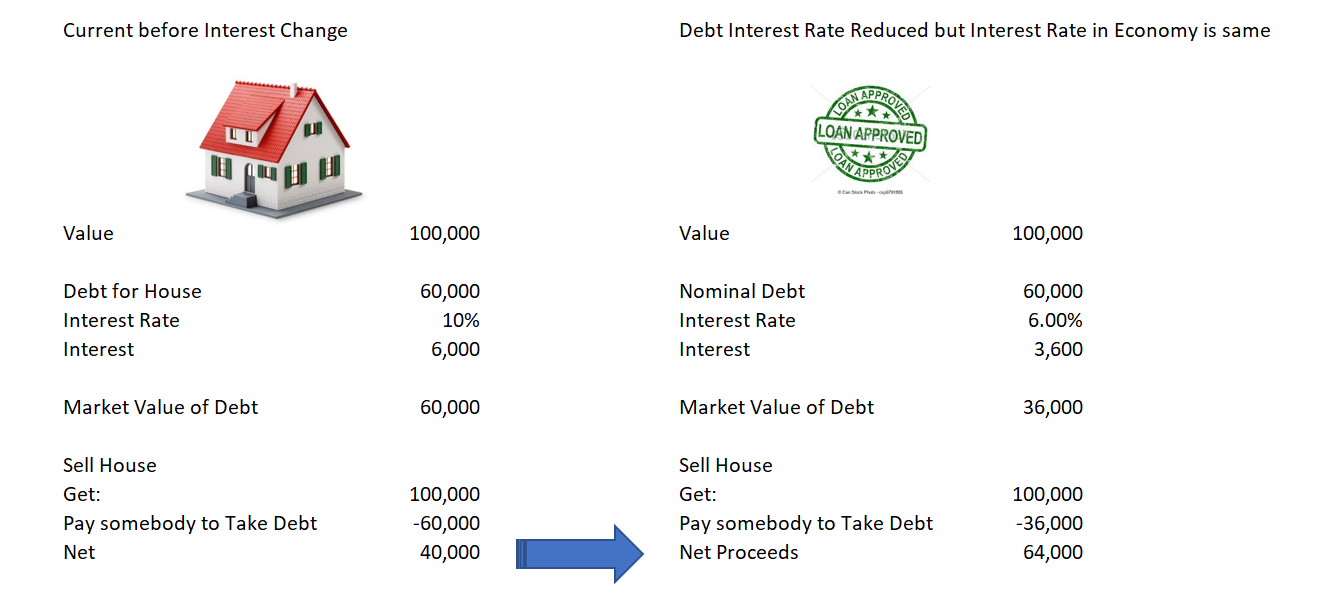

The formula for this calculation can be presented as follows. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deduction as mortgage interest. Learn to increase your cash flow by using tax shields to reduce net income.

Tax Shield Formula. To arrive at this number you can simply use the tax shield formula where you would multiply the depreciation amount of 10000 by the tax rate of 35 which would give. Web formula shield tax uk.

You calculate depreciation tax shield by taking 100000 X 20 20000. Tax Shield Amount of tax-deductible expense x Tax rate. Tax Shield Formula Sum of Tax-Deductible Expenses Tax rate.

Therefore the company can achieve a tax shield of 20000 by leveraging its depreciation. Or the concept may be applicable but have. To increase cash flows and to further increase the value of a business tax shields are used.

The Ascent explains how your small business can shield income from taxes. Interest Tax Shield Interest Expense Tax Rate For instance if the tax rate is 210 and the company has 1m of interest. Investment Cost Marginal Rate of.

It can be calculated by multiplying the deductible depreciation expense by the tax rate applicable to your business. TABLE III A FORMULA FOR CALCULATING THE PRESENT VALUE OF REDUCTIONS IN TAX PAYABLE DUE TO CAPITAL COST ALLOWAICE. The formula for calculating the interest tax shield is as follows.

44 01384 563098 Sales. Tax Shield Donation to Charitable Trusts Interest Expenses Depreciation Expenses Applicable Tax Rate. Tax Shield is calculated as.

The formula for calculating the depreciation tax shield is as follows. Tax Shield 5000 40000 10000. The tax shield concept may not apply in some government jurisdictions where depreciation is not allowed as a tax deduction.

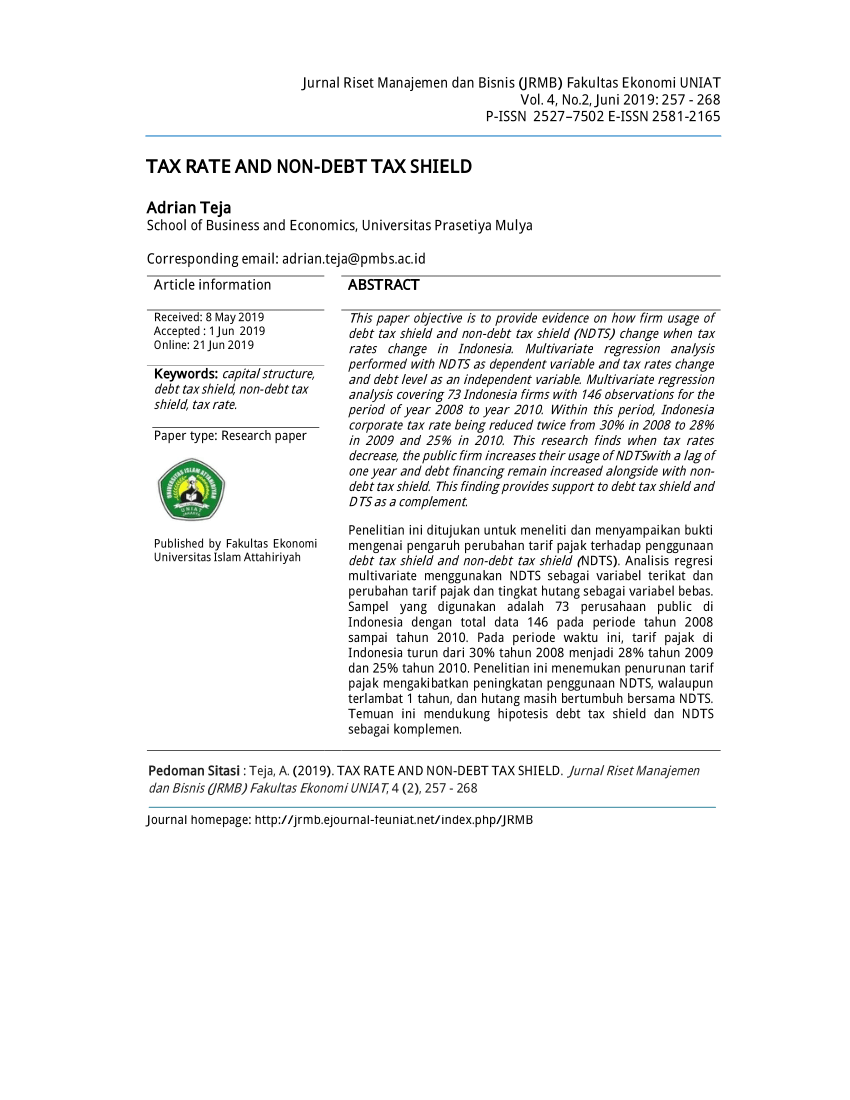

Pdf Tax Rate And Non Debt Tax Shield

Formula Tax Shield Invatatiafaceri Ro

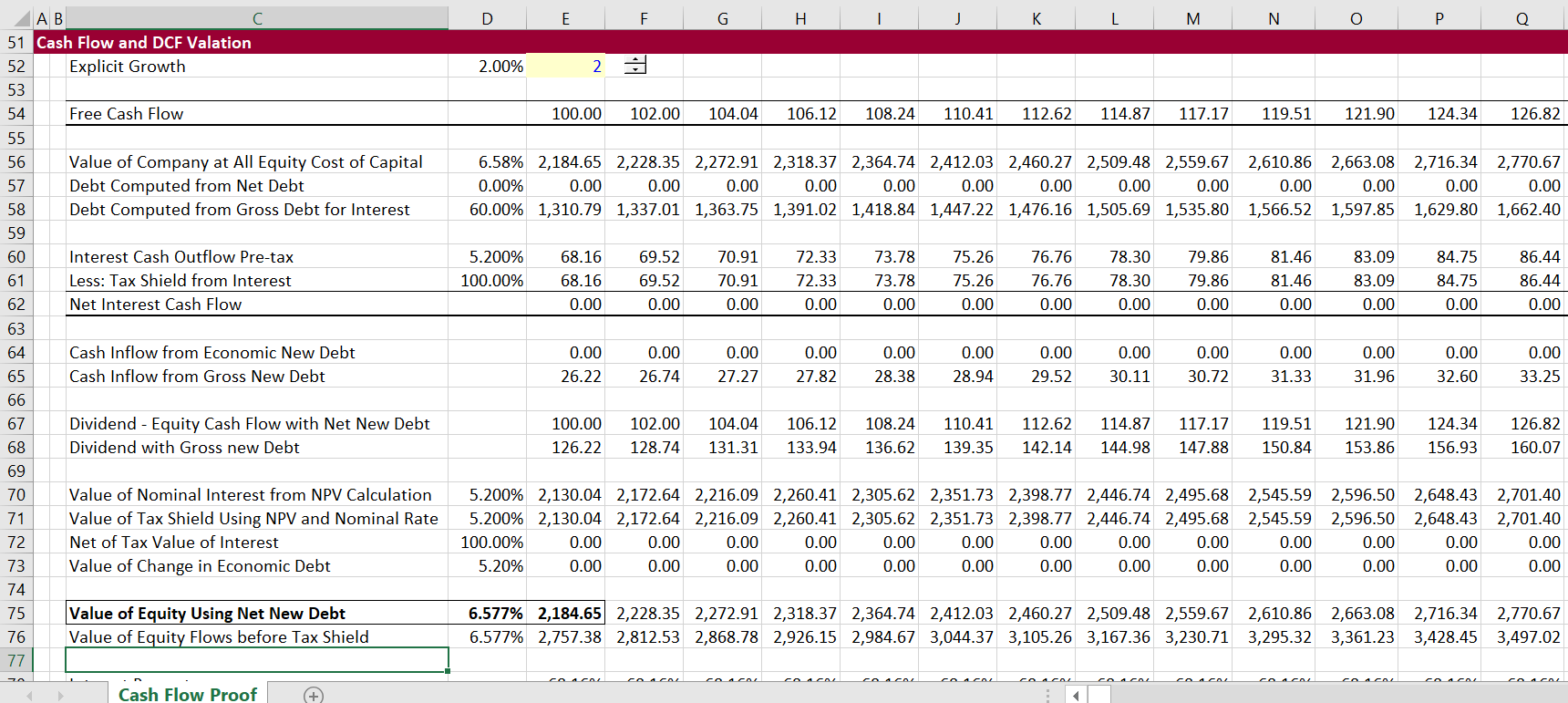

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Chapter 15 Debt And Taxes Section 15 1 15 3 And 15 5 Flashcards Quizlet

Pdf Tax Rate And Non Debt Tax Shield

Reckitt Formula Maker S Sale Spurs Senate Outcry For Justice Department Inquiry Bloomberg

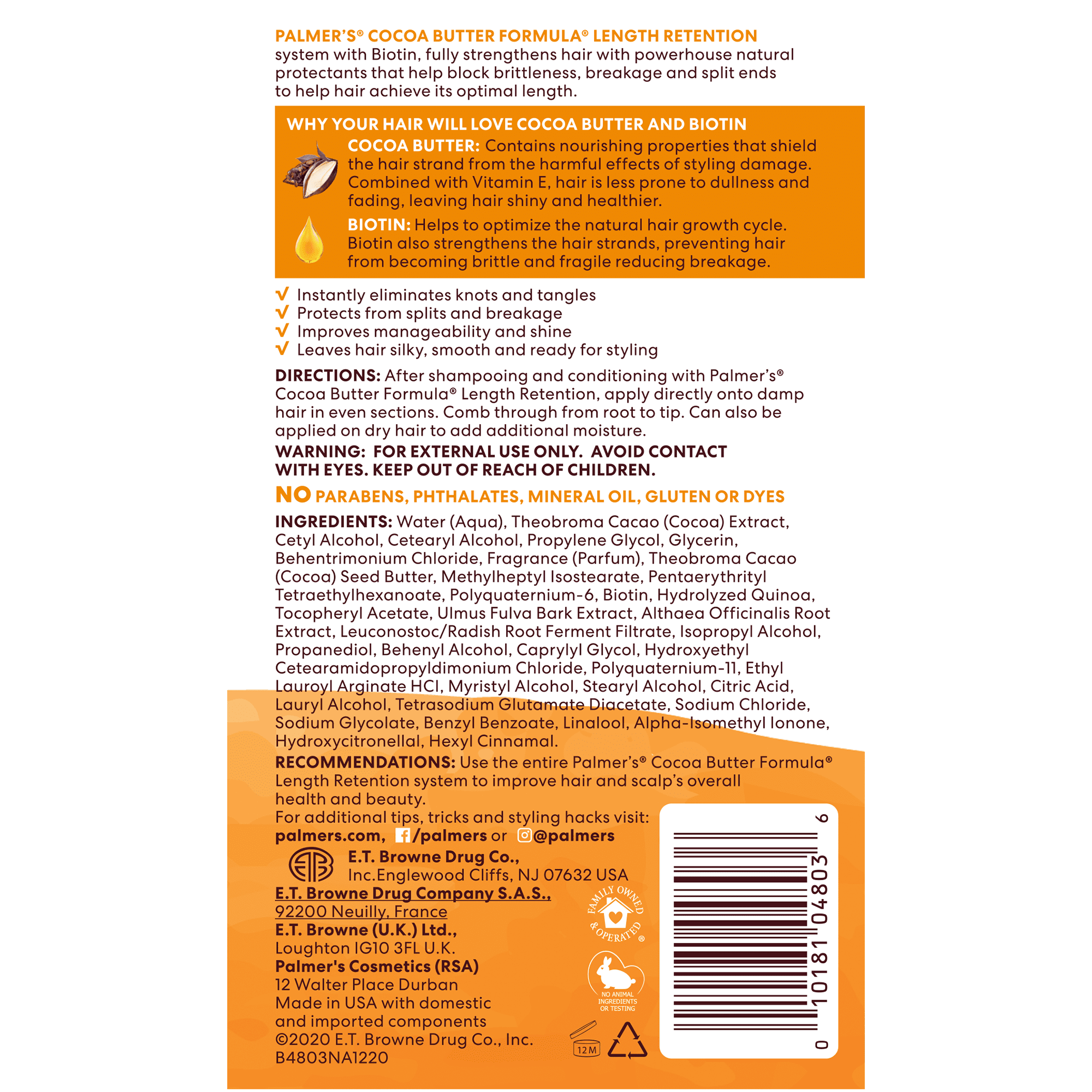

Palmer S Cocoa Butter Formula Biotin Length Retention Leave In Conditioner 8 5 Fl Oz Walmart Com

Amazon Com Palmer S Cocoa Butter Biotin Length Retention 2 Step Hair Mask 1 Ounce Beauty Personal Care

What Is The Difference Between Marginal And Average Tax Rates Tax Policy Center

Tax Shield Formula Examples Interest Depreciation Tax Deductible Wall Street Oasis

Tax Shield Definition Formula For Calculation And Example

Tax Shield Formula How To Calculate Tax Shield With Example

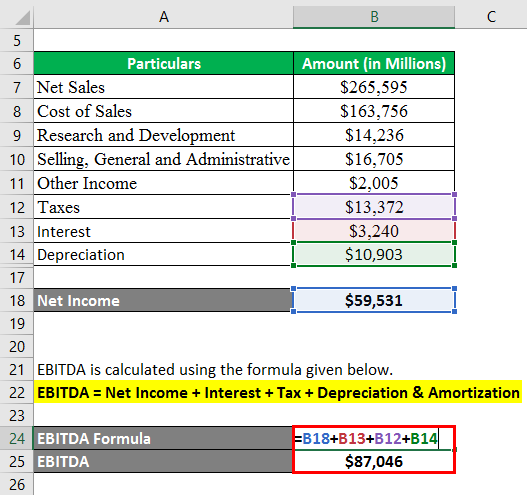

Ebitda Formula Calculator Examples With Excel Template

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Cost Of Capital An Overview Sciencedirect Topics

Tax Shield Formula Examples Interest Depreciation Tax Deductible Wall Street Oasis

What Is Ebitda Formula Definition And Explanation

Out Of The Perfect Capital Market Role Of Taxes Ppt Download